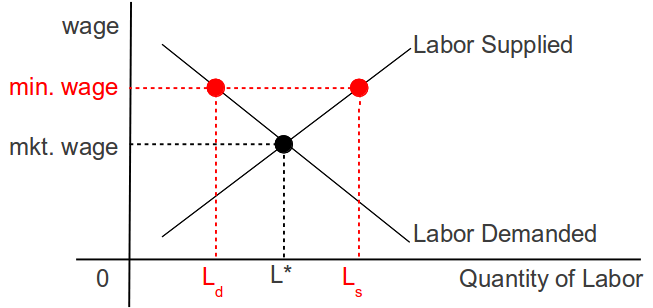

The graph below is the standard, textbook depiction of the effects of a minimum wage on the labor market.

Hardly anyone ever states explicitly what is meant by the quantity of labor, and the tacit assumption is that it refers to hours worked. Considering that the labor theory of value was abandoned except by Marxists and other cranks nearly a century-and-a-half ago, this is a dubious assumption.

However, the graph above is fine for general, broad-brush discussions.

Think of quantity as the number of employees, the number of hours worked for hourly wages, or whatever.

The dotted line in the middle that rises from L* is the market-clearing quantity of labor. This means that the number that choose to work equals the number that employers want to hire at the wage indicated. At any wage below the market wage, fewer choose to supply labor than employers choose to hire (labor shortage); and any wage above the market wage, more choose to supply labor than employers choose to hire (labor surplus, aka unemployment).

Offer 10¢ per hour, and hardly anyone will show up for work. Offer $10,000 per hour, and surgeons, nuclear physicists, and talk show hosts will quit their jobs to come work for you.

If one set the minimum wage at $10,000 per hour, then not only those willing to work for the market wage would be closed out of the labor market, but those willing to work for $9,500 per hour would be closed out.

This process is multiplied by automation.

A half-century ago, about half of the working population in the USA was involved in manufacturing and distribution; today it is a bit less than 10%, and the total value of goods manufactured in the USA continues to exceed the total value of goods manufactured in China.

American factories no longer need an army of proletarian meat-that-talks, when robots are more accurate, don’t organize labor unions, and do not demand insurance and retirement benefits.

It is such a shame that we have so few political rulers who understand basic corporate finance. Instead of increasing employers’ cost of labor, policy makers should be doing everything they can to decrease employers’ cost of labor, if their goal is to reduce unemployment.

If one wants to institute populist policies—and I am not saying that one should, only if—then one would do better to focus on the lower end of the income statement than on the upper end.

Income Statement

+ Gross Sales

- Variable Costs (supplies and materials)

- Fixed Costs (rent, payroll, insurance)

- Depreciation or Mark-to-Market Adjustment

- Interest

= Earnings Before Tax (taxable profit)

- Tax (some percentage of taxable profit)

= Net Income (after-tax profit)

If one raises the minimum wage, one increases Fixed Costs, thereby reducing Earnings Before Tax, and potentially making it negative. In such a situation, the natural response for managers is to reduce the scope of the firm, to automate, or both, and lay off as many workers as is feasible.

Better to let the market determine the appropriate wage rate and to increase the corporate income tax—since it is paid on before-tax profit—and use the additional proceeds to fund transfers to workers. That way, the firms’ executives would have an incentive to increase the scope of the firm, in order to increase Net Income to its previous levels before the tax increase.

Granted, this would create an incentive for firms to relocate to lower-tax jurisdictions, but that’s the sort of thing that one must accept, if one insists on instituting populist policies.

At the very least, the effects of the corporate tax would be known and predictable—X% of taxable profit—rather than hit-or-miss increases in payroll costs caused by the arbitrary political fiat of a minimum wage.

Invest accordingly.

Prof. Evans