The vast majority of firms do not pay dividends, which renders the use of dividend discounting methods for estimating their values moot. In this case, one can use discounted expected cash flows: net income (NI), operating cash flows (OCF), or free cash flows (FCF), depending on the level of sophistication required by the analyst. However, all of these require the analysis of the firm’s financial statements, which might involve more effort than one is willing to expend in a preliminary analysis.

With publicly traded firms that do not pay dividends, another option exists using the price/earnings ratio (P/E).

Remember that:

NI = Dividends + Retained Earnings

P/E = Equity/NI

NI is the pool of funds from which a firm would pay dividends if it paid dividends, and dividend discounting models assume that all of the value of the firm is paid out to shareholders in the form of a dividend (D).

In this way, we can see P/E = Equity/NI as being similar to P/E = price-of-equity (P) / D:

P/E = Price / Dividend = P / D

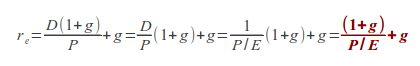

To use this in our dividend discount formula, we need to take the reciprocal:

where

| re | : return on equity / cost of equity |

| D | : dividend |

| P | : price |

| P/E | : price/earnings ratio |

| g | : growth rate |

Start with the P/E ratio, take its reciprocal (1 ÷ P/E), multiply by (1+g), and then add g.

You can practice this in the WACC Quiz, by clicking the Practice link above.

I hope that this helps.

Prof. Evans