3 November 2012, Clayton Christensen, whose earlier works I have found inspirational and illuminating, published an article in the New York Times—”A Capitalist’s Dilemma, Whoever Wins on Tuesday“—that starts with a reasonable premise, and veers hopelessly off course.

To Wit: “Whatever happens on Election Day, Americans will keep asking the same question: When will this economy get better?”

Fair enough. That is a very reasonable question, and it is a very reasonable expectation that Americans will keep asking it.

So far, so good.

Then, we get this:

“The Fed has been injecting more and more capital into the economy…”

<facepalm>

The Fed has been pumping more and more money into the economy. The value of money is measured by the ratio of units in circulation to the value of stuff. If the number of units in circulation increases faster than the quantity, value, or both of stuff, then prices rise.

Capital is the long-term means of production: drill presses, trucks, robots, etc.. The Fed doesn’t have any of that, and Fed governors are not in a position to command others to make such things available.

The Fed lends money to the US Treasury, buys toxic assets from commercial banks, and regulates banks. It isn’t a hardware store.

Now, if one is sitting on a lot of money that one can convert into capital assets, then one might adopt the financier’s habit of referring to that money as capital, but one should avoid conflating fiat inflation with the means of production.

“And yet cash hoards in the billions are sitting unused on the pristine balance sheets of Fortune 500 corporations.”

Firms are supposed to keep pools of cash as a kind of self-insurance policy against slow economic times. We call this ‘working capital’. When the future is even scarier than normal, the prudent thing to do is to hold more cash. The ‘Fiscal Cliff’, Pres. Obama’s political rhetoric expressing open disdain for those who are wealthier than he, the unknowable effects of Obamacare, the ongoing transition away from a capital/labor economy toward a service/knowledge economy, and the specter of another decade of ‘Bush’s war’ are enough to render all expectations of the future little more than random bets and wild guesses.

And, no one gets fired for playing it safe. So, until things settle down, executives play it safe.

“Billions in capital is also sitting inert and uninvested at private equity funds.”

Does Prof. Christensen believe that fund managers have piles of big, canvas sacks with dollar signs on them, filled with cash… like Scrooge McDuck or the dapper little fellow from the Monopoly™ game?!?

The money is invested somewhere, most likely US Treasury debt, because the US Treasury has a reputation of always paying its debts… even if it has to print more money to do so. In these highly uncertain times, the safest bet is the safest bet.

“Empowering innovations create jobs, because they require more and more people who can build, distribute, sell[,] and service these products.”

Sadly… no, no, no, and no.

Build: Factories are increasingly automated, and when meat-that-talks is needed, one hires labor where it is cheap; i.e. Latin America, Southeast Asia, and increasingly Sub-Saharan Africa.

Distribute: DHL, FedEx, UPS, already have that pretty well covered.

Sell: Amazon.com.

Service: What is that? Throw it away and buy a new one.

“[T]he Toyota Prius hybrid is a marvelous product.”

Except that [o]nly 35 percent of hybrid car owners bought a hybrid again when they purchased a new vehicle in 2011.

“‘[E]fficiency’ innovations… almost always reduce the net number of jobs…”

This one is spot-on. It is unfortunate that Christensen did not make it the centerpiece of his analysis.

“The economic machine is out of balance and losing its horsepower. But why?”

Peter Drucker answered this question in Post-Capitalist Society , which was written nearly twenty years ago, and reads today like a play-by-play account of what happened in the 1990s and 2000s.

, which was written nearly twenty years ago, and reads today like a play-by-play account of what happened in the 1990s and 2000s.

[Reread the sentence above, click on the link, and buy the book. You can thank me later.]

Also, the total value of goods manufactured in the USA continues to exceed the value of goods manufactured in China.

The scorpion’s sting is in the tail. Toward the end of the article, Christensen states, “We can use capital with abandon now, because it’s abundant and cheap. But we can no longer waste education, subsidizing it in fields that offer few jobs.”

No one knows where the ‘jobs’ of the future will be. Social engineering always fails. In the 1960s, it was plastics; in the 1980s, software development; in the 1990s, Dot.Com… No one knows what it will be next decade.

“[T]he [capital gains tax] rate should be reduced the longer the investment is held — so that, for example, tax rates on investments held for five years might be zero — and rates on investments held for eight years might be negative.”

It might have made sense a century ago, when technology changed slowly, to make it costly to change plans quickly in response to new information, but Christensen’s advice in a highly dynamic—even chaotic—integrated global economy would create an incentive to keep sub-optimal plans running beyond their use-by dates.

“Federal tax receipts from capital gains comprise only a tiny percentage of all United States tax revenue.”

This suffers from two fatal flaws. 1) The universe does not end at the US border. 2) If capital gains represent a trivial portion of the federal budget, then eliminate the cost of collecting and enforcing them and call for their repeal. Leave the money in the owners’ hands, rather than seize it at gunpoint, if it is hardly worth collecting.

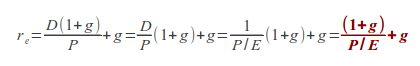

“It’s true that some of the richest Americans have been making money with money — investing in efficiency innovations rather than investing to create jobs. They are doing what their professors taught them to do, but times have changed.”

Indeed, times have changed, but that does not mean that this time is different, as Christensen seems to assume. We are in the latter stages of a transition as profound as the 18th Century Industrial Revolution, from a capital/labor division—in which semi-literate proletarians drive industrial machines—to a knowledge/service division, in which skilled workers are the ‘capital’ and are not interchangeable.

However, the wealthy will invest where they expect the greatest opportunities are, as has been the case since the Renaissance a half millennium ago. When princes, presidents, and parliamentarians create uncertainty, the wealthy will hunker down and wait until circumstances stabilize.

Christensen started with the premise that the president and the Fed do not have the power to fix things, and then concluded that the IRS does have such power.

This conclusion is counterintuitive. An alternative would be for presidents, princes, and parliamentarians to enforce transparency, and otherwise to mind their knitting, rather than concern themselves with affairs that are beyond their abilities.

Invest accordingly.

Prof. Evans