Much talk about Bitcoin centers on the claim that it represents some kind of existential threat to the US dollar (USD) specifically, fiat currency generally, and maybe even the nation-state as a social institution and organizational structure. Considering that the total value of Bitcoin in circulation today, in June 2013, is approximately USD 1.25 billion, or 2% of Carlos Slim’s personal portfolio, one might easily conclude that Bitcoin fanboys are drunk on their own fumes and perhaps getting just a little bit ahead of themselves.

Deflating Inflation Fears

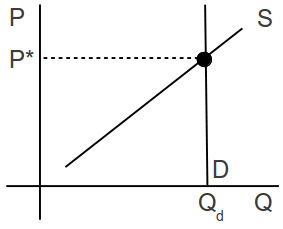

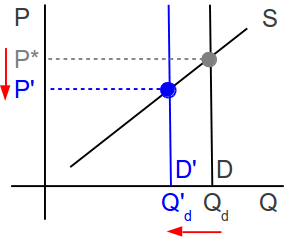

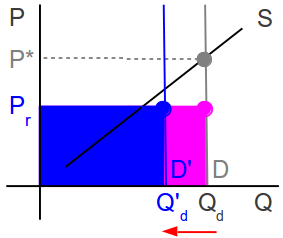

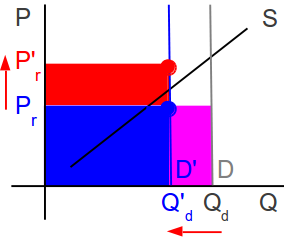

In general, and all other things held constant (or, as we say in the business, ceteris paribus), prices can rise for three reasons: demand increases (e.g., an auction or a popular restaurant), supply decreases (e.g., lower efficiency, war, or natural disaster), or the number of units of currency increases faster than the rate of increase of goods and services (inflation).”

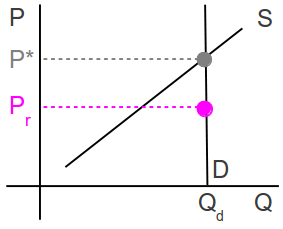

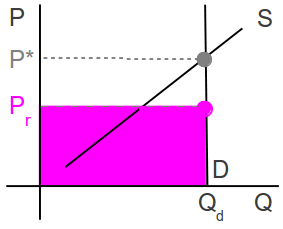

If it fulfills even some of its potential, then Bitcoin could mitigate USD inflation, by increasing the economically relevant supply of available goods and services via the reduction of transactional friction, especially across borders and among the unbanked.

As things stand, a consumer in Suburbia is restricted to local merchants who will accept fiat cash and equivalents, stored-value cards, or cards tied to the banking system, on the one hand, and to online merchants who will accept stored-value cards, or cards and online derivative services tied to the banking system, on the other hand. That’s pretty much it.

Many of the payment systems that are tied to the banking system are either expensive or impossible to use across borders. This means that the supply of goods and services available to the Suburbian consumer is constrained by legacy and political inefficiencies in the international banking system.

The World’s Second-Largest Economy

With virtual currencies generally and Bitcoin specifically, consumers in Suburbia can buy goods and services from suppliers in Outland that hitherto have been out of reach, meaning that they effectively do not exist from the Suburbian perspective. While this might seem trivial to a Suburbian whose entire economic life is spent, as it were, in Suburbia, it is a daily headache for Outlandish suppliers and consumers, who comprise a rather significant economic force.

G’won… Click on the video!

For example, it is very difficult for local hotel operators in much of Latin America and the Caribbean to accept credit card payments directly from foreign guests as deposits prior to travel. This means that the foreign guests will tend to stay at hotels run by large international chains, putting the local hotels at a severe disadvantage. If a hotel operator in Latin America or the Caribbean accepted Bitcoin, even if only for the initial deposit, then anyone in the world could make reservations easily, and the effective worldwide supply of hotel rooms would increase.

This same story can be told for as many goods and services as one can imagine: coffee from small-scale roasters in Central America, small-label hot sauces from sub-Saharan Africa, local distilled spirits from the Caribbean, textiles from Southeast Asia, crafts from pretty much everywhere, personal services, software development, graphic design, world music, etc.

Before one dismisses the total value of small-scale global trade, one should consider that during the 2012 presidential campaign, Pres. Obama raised tens of millions of dollars in small-sized contributions, and that 83% of the world’s population lives outside the OECD. This same e pluribus magnum power of large quantities of small transactions is the driving force behind crowdfunding, which also can be facilitated globally much more easily with Bitcoin than with legacy options.

In the video above, Robert Neuwirth refers to the worldwide informal economy as the world’s second-largest economy. And, they don’t have bank accounts, credit cards, or access to capital markets, but they do have mobile phones, many of which can run Kipochi, even if they do not have smartphones that can run a Bitcoin wallet.

Ponder that for a moment, before reading further.

Somewhere in Nairobi, some street vendors are carrying more powerful financial technology in their pockets than 90% of the Suburbians reading this have in their whole houses.

Fear, Uncertainty, and Doubt

Bitcoin could essentially conjure into existence for Suburbians the goods and services produced by 5.75 billion potential trading partners in Outland that currently might as well be in some parallel universe. In so doing, the USD/stuff ratio (i.e., price level) could fall, even if the numerator (USD money supply) continued to grow at historically unprecedented rates, so long as the denominator (cool stuff from Outland) were allowed to grow even faster.

That’s right, widespread Bitcoin adoption could mitigate inflation! Those who claim the opposite assume that Bitcoin will supplant the USD for existing transactions, and that the two payment media will vie for shares of a fixed-sized pie, like two dogs fighting over a bone, which is silly. Chinese refinery operators are not going to buy Saudi Arabian oil with Bitcoin any time soon, as the percentage savings would be less than trivial. The USD will continue to function where legacy systems work well, and Bitcoin could open markets that have never existed before, if allowed to.

One concern that one comes across with distressing frequency is that tax collection might be made more difficult, if large numbers of Suburbians started transacting in Bitcoin, but there are alternatives to income taxes that can be as progressive as policy makers want them to be, including a national land tax based on assessed value, luxury goods taxes, automobile taxes based on sale price, etc., and tax collectors still can demand that all taxes be paid in local fiat and charge a conversion tax on Bitcion exchanges into the local currency. These suggestions should not be mistaken for a paean to the social welfare state, but merely as evidence that the taxation critique of virtual currencies is a red herring. Similarly, concerns about money laundering and terrorist financing are overblown, especially given the existence of Bitcoin’s publicly available blockchain, which records every Bitcoin transaction that has every been cleared and every Bitcoin user—including law enforcement and taxation agents— has access to.

Setting aside the red herrings, straw men, and other knee-jerk overreactions from luddites, the real issue is how Bitcoin can grease the wheels of small-scale global commerce, thereby removing the vast amount of friction from transactions across borders… which could ease inflationary pressure on the USD.

There’s Nothing to Fear but Fear, Itself

Should bankers be afraid of Bitcoin? Absolutely not! They can earn from the exchange into and out of Bitcoin, serve as escrow agents for Bitcoin users who prefer not to keep their holdings under a proverbial mattress, they can facilitate Bitcoin loans, use Bitcoin as a reserve asset, etc.

Should regulators be afraid of Bitcoin? No more so than any other commodity. In fact, perhaps even less so, seeing as how commodity markets are largely unregulated; it is the commodity derivatives markets that are regulated, and Bitcoin is a commodity, like gold, oil, or wheat, and not a derivative, like an option or a future. Now, if people start issuing options and futures contracts on Bitcoin, the of course regulators will have quite a lot to say.

Should law enforcement agents be afraid of Bitcoin? Hardly! The blockchain that memorializes every Bitcoin transaction for posterity can be read into a database and sifted every way imaginable using Big Data techniques. Also, it is remarkably easy to set up a sting operation with Bitcoin, which already seems to be happening.

Should tax collectors be afraid of Bitcoin? Perhaps, if their goal is to tax Bitcoin-denominated transactions that do not intersect with the banking system. However, anything that touches the banking system directly is recorded in accordance with banking regulations, and anything that touches the banking system indirectly is likely to drag the tax evader’s fingerprints through the blockchain, which is available to all without a subpoena.

Welcome to the 21st Century

Bitcoin is part of a larger transition away from the capital/labor economy to the service/knowledge economy. Welcome to the Age of Decadence, where disruptive innovations in engineering, entrepreneurship, and entertainment are announced with mind-boggling frequency. If government legislators and regulators clamp down on the work of frighteningly intelligent and disobedient young men and women, then that work will go to where it is tolerated, even if not embraced, per se, thereby impoverishing the populations that the governments are supposed to serve, protect, and represent.

Skype and Twitter are making a joke of national telephone monopolies. Remote collaboration tools are making a joke of immigration restrictions, and thus labor regulations. Free and open source software and hardware development tools are making a joke of patent and copyright regimes. The only way to stop or even slow this process would be to disconnect your country from the Internet, and, seriously, do you really want to do that?

Some legislators and regulators will try to shovel back the tide, and their people will be held back, as were the people of the USSR, Ghaddafi’s Libya, the military dictatorships that once reigned in Latin America, and Burma, Cuba, and North Korea today. Other legislators and regulators either will embrace or at least tolerate the inevitable change, and their people should fare well. Yet others will strike some middle path, with varying results.

What US officials in the Federal Reserve, the US Treasury, the Department of Homeland Security, the Internal Revenue Service, etc. do is anyone’s guess. It is obvious from my comments here what my hope is, and I continue to live in the USA.

If there are any Hortons in Congress… yop.

Invest accordingly.

Prof. Evans